About the fund

We believe portfolio managers need to look forward with a discriminating approach that dynamically adjusts for pockets of opportunity. Alternative asset classes should be one intentional lever used to diversify portfolios to balance dynamic adjustments.

Hamilton Capital Dynamic Alternatives fund seeks to add potential sources of return enhancement and risk mitigation not available by owning traditional equity and fixed-income investments alone.

Additional asset classes targeted include:

-

Hedge Funds

-

Real Estate

-

Private Equity and Private Credit

-

Natural Resources and Infrastructure

-

Structured Products

-

Additional Asset Classes

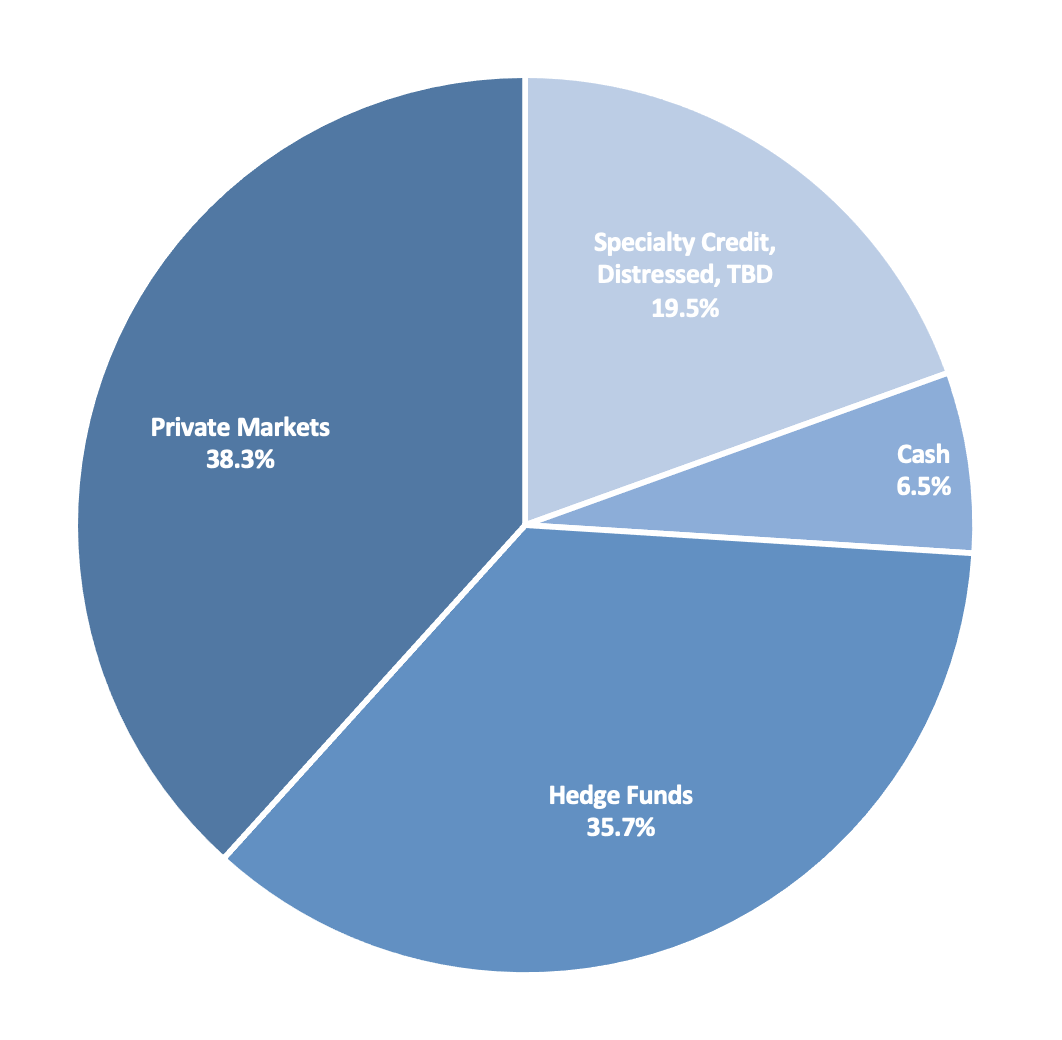

A “Sample” Allocation

Portfolios that include alternative investments normally invest significant percentages of their funds into different sectors and limit their exposure to fixed income. The potential allocation shown at right highlights the breakdown of possible asset classes for a hypothetical portfolio at the three-year mark.

This sample allocation is for illustrative purposes only and does not represent the current Hamilton Capital Dynamic Alternatives sector allocation.

How alternative investments fit into your investment portfolio:

At Hamilton Capital, we are committed to helping our clients meet their investment objectives by seeking quality absolute returns that achieve more consistent results and avoid large losses. We employ a dynamic, forward-looking allocation process that includes both traditional and alternative investments in our global search for value.

In the decade ahead, global investment returns are widely expected to fall below historical norms due to high valuations and rising interest rates. Traditional long-term strategies that buy and hold market assets will be challenged to deliver the returns investors need. We believe that successful portfolio construction will include a progressive, discriminating approach that includes a meaningful allocation to alternative investments.

Access to private equity, private debt, and marketable alternative strategies adds potential sources of return enhancement and risk avoidance not available by owning traditional equity and fixed-income investments alone. Accordingly, we believe that adding alternative assets to your portfolio could play a key role in helping you meet your investment goals.